Selecting a Fund Administrator

August 11, 2022 | 6 minutes read

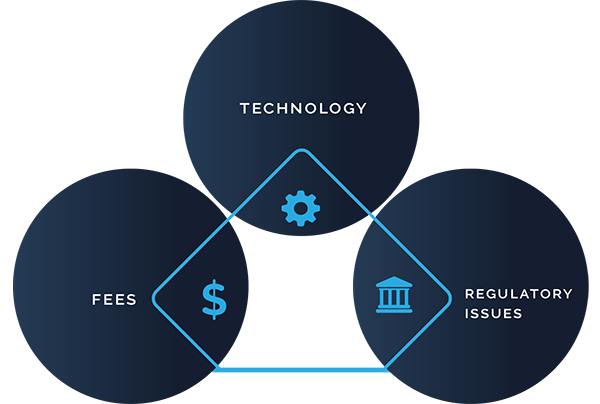

TABLE OF CONTENTS

- Evaluating prospective administrators

- Technology platforms

- Understanding fund administration fees

- Regulatory issues

Selecting a fund administrator is one of the first and most important decisions you’ll make as a fund manager. It is critical to get it right because your administrator will handle a multitude of key functions including valuing your fund, fund accounting, financial statement preparation, investor and audit support. Diligent research upfront is imperative since this is expected to be long-term relationship.

Using a third-party fund administrator can generate backoffice efficiency, provide valuable expertise, and contribute to a fund’s overall operational alpha by allowing a manager to focus on their core strengths: portfolio management and capital raising.

So as a fund manager, what should you be looking for in an administrator? We have created guidelines to help you get started.

Evaluating prospective administrators

Prior to launching a new fund, a fund manager should select a fund attorney, an administrator, a bank and a prime broker in that order. Many later stage requirements hinge on the completion of earlier steps. For example, a fund attorney will first need to draft offering documents and finalize them incorporating specific language provided by the administrator. And banks won’t open a fund account until fund documents exist.

Your search for a fund administrator can begin by requesting referrals from knowledgeable industry insiders, researching providers online and undertaking your own due diligence. By reviewing online testimonials, you’ll gain insight into the client experience, and may limit the need for an expansive search.

Before speaking with prospective administrators, understand the legal definition of terms and conditions outlined in your fund’s offering documents. To state the obvious, if your fund has monthly liquidity, you will need to hire an admin for monthly services. Typically, the less liquid the underlying investments, the less reporting periods investors will require. Funds that employ a large amount of leverage will want more frequent reporting.

Also, keep in mind what type of reporting potential investors will want to see when they perform a due diligence review of your operations. The more institutional and sophisticated your potential investor base, the more detailed your fund’s reporting will need to be. As an example, if you employ a great deal of leverage in your strategy, a sophisticated investor will want to see a draw-down analysis to see how you have successfully managed risk and margin.

- Speak with industry insiders to learn more about each firm’s reputation and experience.

- Understand which global jurisdictions they service.

- Look for a firm with a low employee turnover and a high long-term client retention rate. As your fund grows, you’ll want a knowledgeable, experienced account manager providing service continuity.

- Learn about each firm’s technological capabilities, and their ability to customize technology and reporting to meet your needs.

- Ask about their fees-understand what is included in the basic fee and what will warrant additional fees.

- Ask about the onboarding processes, including initial steps, what’s required of you and the expected time from start to completion.

- Ask for client references.

Technology platforms

Researching a prospective administrator includes understanding its technology systems, its capabilities and how they align with your fund’s needs and strategy. A fund administrator can increase fund operational efficiencies by automating manual processes and leveraging technology to offer scalable solutions. Consider the following questions to learn more about an administrator’s technology:

- Is the administrator’s platform proprietary or is it third-party licensed software?

- How flexible are each firm’s reporting capabilities?

- If you use a complex, proprietary trading strategy, can the software easily accommodate it? Knowing this upfront may eliminate excess fees, programming charges or time delays that may make your trading strategy unmanageable or unprofitibility.

- What processes and systems are in place to protect investor data?

- Is the administrator ISAE 3402 Type II certified?

- Is the administrator SOC2 certified?

Understanding fund administration fees

Basic fund administration fees may vary widely for similar services and can range from several hundred to several thousand dollars a month, depending on the provider, a fund’s AUM and its trading complexity.

Be aware of additional fees that may be charged by some administrators for anything considered not standard. The price quoted may not include items such as complex transaction fees for OTC trades, broken deal fees for private equity funds and month-end pricing fees for hard-to-value securities.

Additional fees may also be incurred for annual financial statements, tax services, set-up fees, US/foreign tax returns, licensing and technology fees. When in doubt, ask questions upfront. For example, a fund administrator may require fund clients to upload their own pricing files and journal entries at month-end. This means, although you’ve hired a fund administrator to handle this function, you will still be doing some of the work.

If your fund is registered with the NFA or SEC, ask if the administrator can help with filling Form PF or NFA PQR. NAV Fund Services typically supports report filling at no extra charge, while some other administrators will charge hefty fees for this service.

If you’re an emerging manager with a relatively small assets under management (AUM) base, look for an administrator who handles other similarly sized funds. A larger admin may not be interested in your business, and your service and/or fees may reflect this. Considering a medium- or small-sized administrator may be a prudent alternative. Additionally, smaller funds will want an administrator that can be their partner as they grow.

Regulatory issues

Since most fund administrators in the U.S. are not regulated and your administrator will be managing your accounting and reporting, learn more about their own interactions with regulatory agencies as part of your research. Has the administrator been involved in litigation or fined by the SEC? Any questions raised can be addressed as part of your due diligence.

There are many excellent reasons to outsource your fund administration functions to a third party administrator. Due to the volume of clients served, they can automate processes that might remain labor intensive for a fund’s in-house staff. Many institutional investors prefer - and may require - the transparency provided by an independent third-party’s reporting and valuation. This is a long-term relationship and asking the right questions upfront may save your fund time and money.