Recent Digital Assets Tax Developments You Should Know About

October 1, 2023 | 4 minutes read

New reporting requirements

The Department of the Treasury and the Internal Revenue Service (IRS) have issued proposed regulations in response to a provision in the 2021 Infrastructure Investment and Jobs Act that would impose new tax reporting requirements starting with the 2026 tax filing season for digital assets sales and exchanges taking place on or after January 1, 2025. Most importantly, this reporting would require cost basis information going back to January 1, 2023.

The new regulations would require digital assets brokers -- including exchanges, payment processors, and decentralized platforms -- to issue a new Form 1099-DA to both the IRS and digital assets holders detailing sales/exchanges for cryptocurrencies like bitcoin and ether, as well as non-fungible tokens. The intention of the new reporting form is to give investors the ability to more easily and accurately determine their tax liabilities without the need for complex calculations.

Treatment of non-fungile tokens as collectibles

IRS Notice 2023-27 announces its intention to issue guidance for the treatment of certain non-fungible tokens (NFTs) as collectibles under section 408(m) of the Internal Revenue Code. This action will help better determine the applicable long-term capital gains tax rate under section 1(h).

Until the new guidance is issued, the IRS will employ a look-through analysis to treat an NFT as a collectible if the NFT's associated right or asset falls under the definition of collectible in the tax code. For example, a gem is defined as a collectible under section 408(m), thus an NFT that certifies ownership of a gem will be deemed as collectible.

Tax treatment of cryptocurrency stacking rewards

IRS Revenue Ruling 2023-14, issued on August 31, 2023, clarifies when and how staking rewards are included as taxable income for cash-method taxpayers. The IRS ruling states that staking rewards received by cash-method taxpayers must be included in gross income for the taxable year in which the taxpayer acquires dominion and control over the awarded cryptocurrency. The amount of includible income is based on the reward's fair market value on the date the taxpayer gains dominion and control. Dominion and control generally refers to the taxpayer's ability to sell or otherwise transfer the asset.

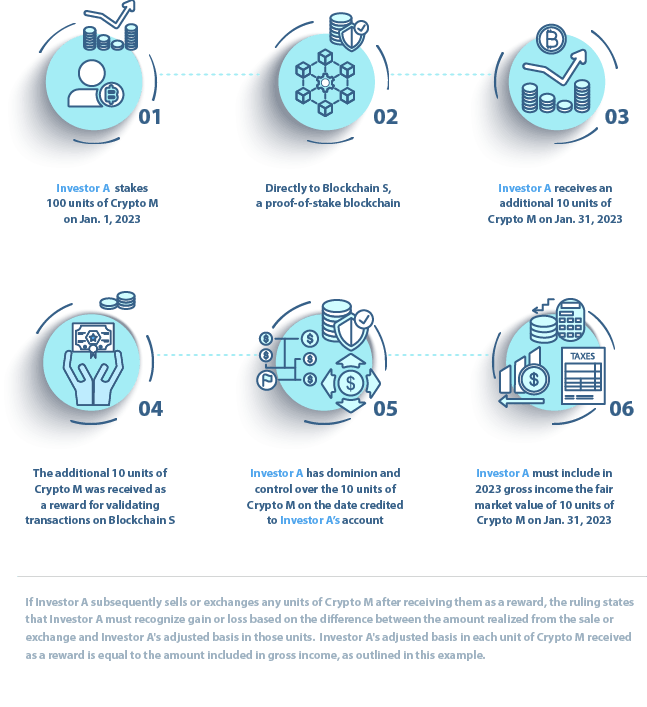

Per the ruling, this treatment applies whether the taxpayer stakes directly to a proof-of-stake blockchain or receives additional tokens through staking on an exchange. For example: A stakes 100 units of Crypto M on January 1, 2023 directly to Blockchain S, a proof-of-stake blockchain. On January 31, 2023, A receives an additional 10 units of Crypto M as a reward for validating transactions on Blockchain S. A has dominion and control over the 10 units of Crypto M on the date they are credited to A's account. Therefore, A must include in 2023 gross income the fair market value of 10 units of Crypto M on January 31, 2023.

If A subsequently sells or exchanges any units of Crypto M after receiving them as a reward, the ruling states that A must recognize gain or loss based on the difference between the amount realized from the sale or exchange and A's adjusted basis in those units. A's adjusted basis in each unit of Crypto M received as a reward is equal to the amount included in gross income, as outlined in this example.

Financial product provisions in 2024 revenue proposals

Certain provisions in the Biden Administration 2023 Revenue proposals also impact digital assets tax reporting. The Expansion and Modification of the Wash Sale Rules would broaden the scope of wash sale rules to cover digital assets. Additionally, Expansion of Code Sec. 475 to Digital Assets Dealers and Traders would add a third category of assets -- "actively traded" digital assets and derivatives on, or hedges of, those digital assets -- that a dealer or trader in those assets may elect to be marked to market.